New analysis of the EU reporting landscape 2011-2024 exposes legal certainty issues

In recent years, the landscape of tax reporting has undergone a profound transformation driven by technological advancements and regulatory initiatives. The integration of digital tools and the emergence of Big Data have revolutionized how tax authorities gather, analyze, and utilize information. The reporting burden on companies has significantly increased, and the rules often give rise to difficult assessment issues for both businesses and tax authorities. Concerns over legal certainty—particularly predictability, proportionality, and objectivity—have emerged as crucial considerations.

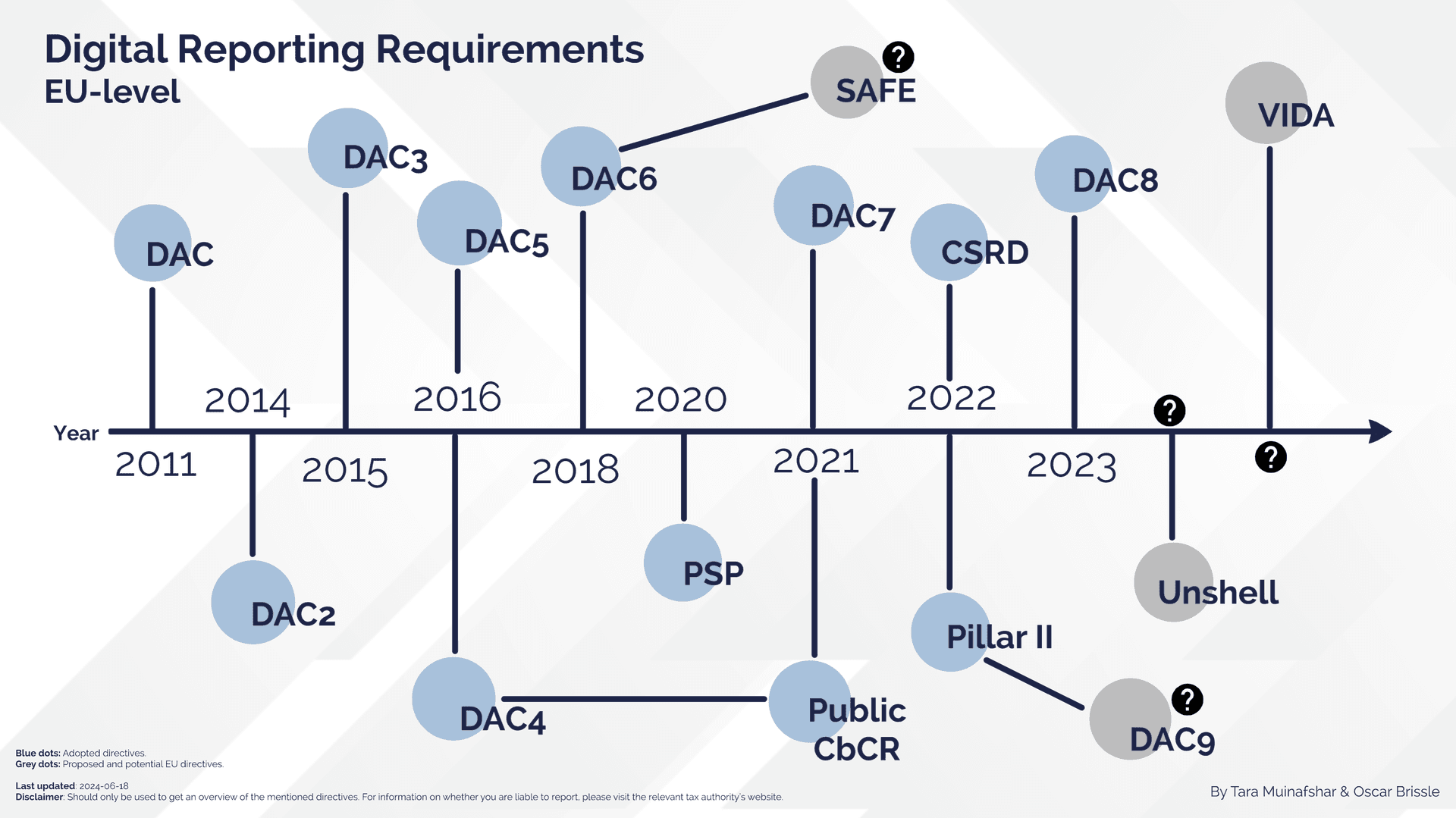

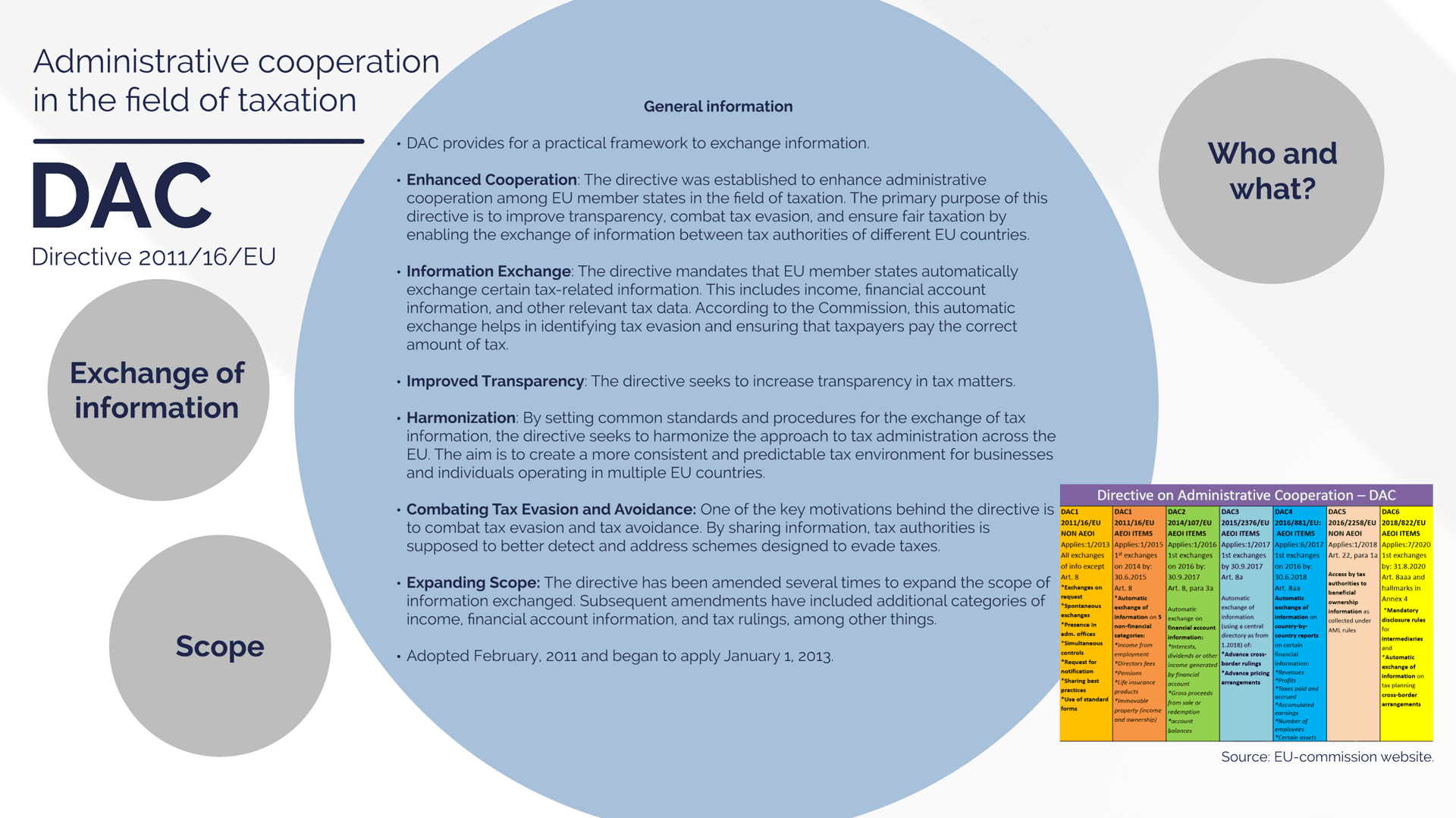

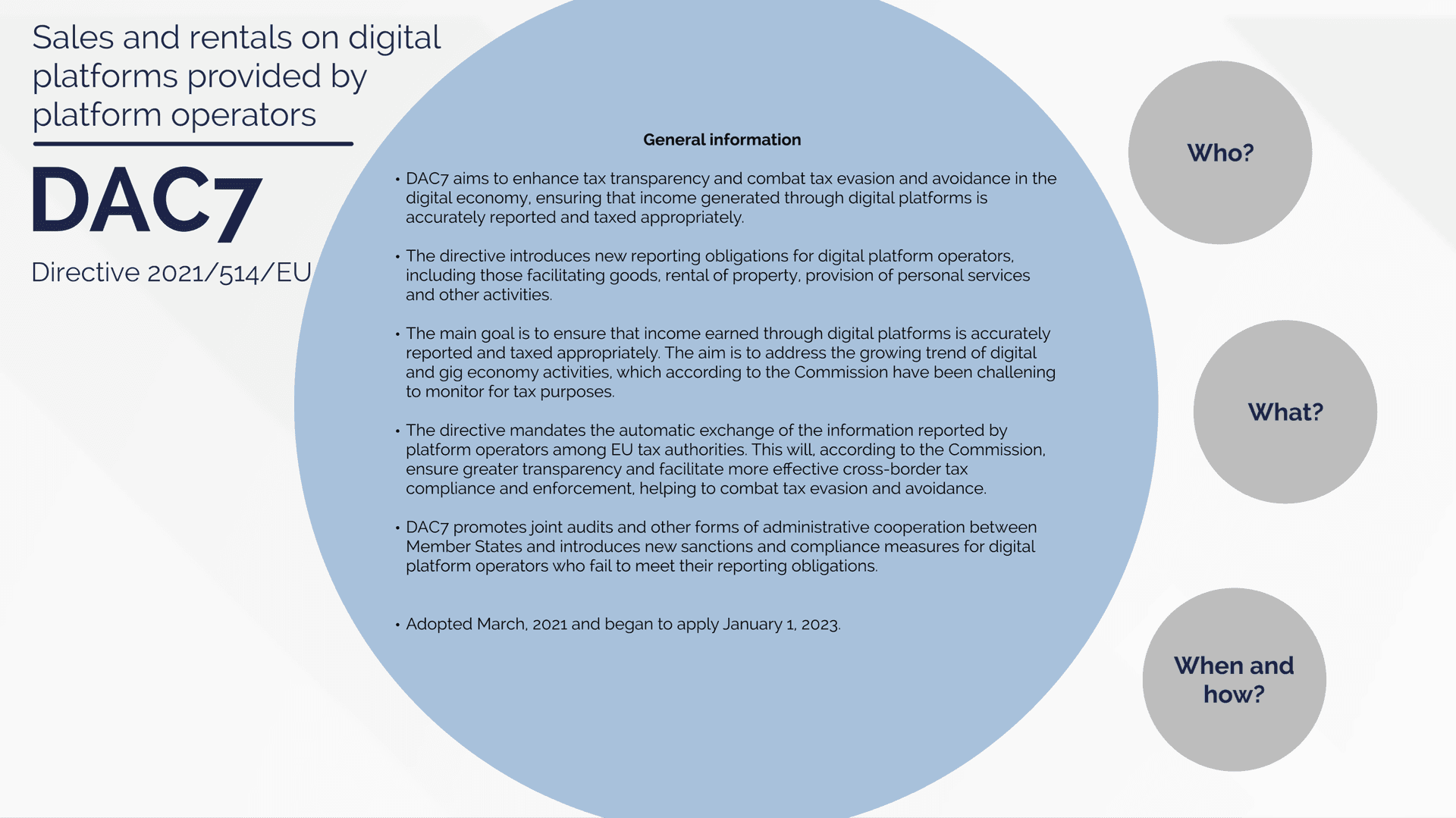

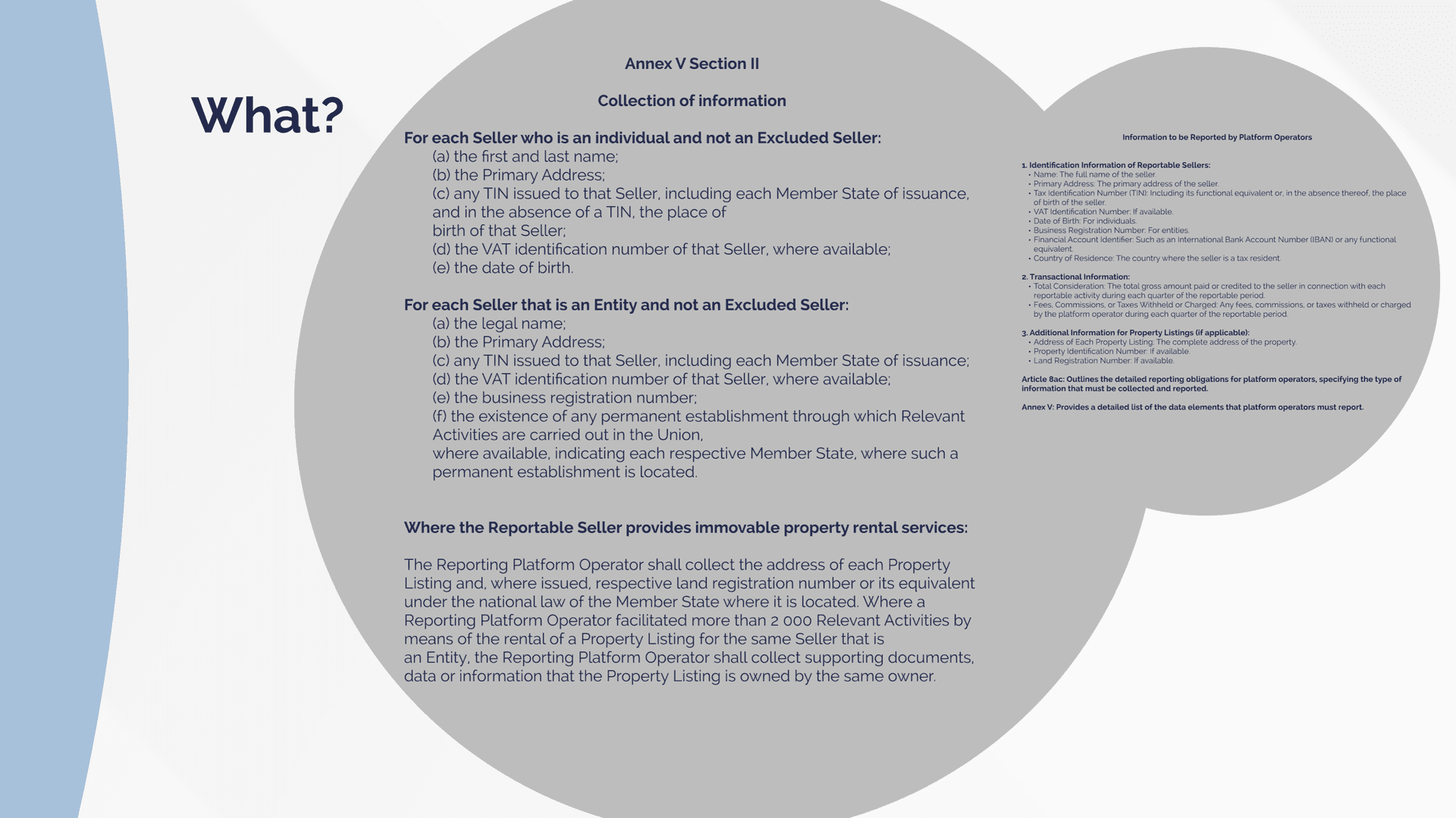

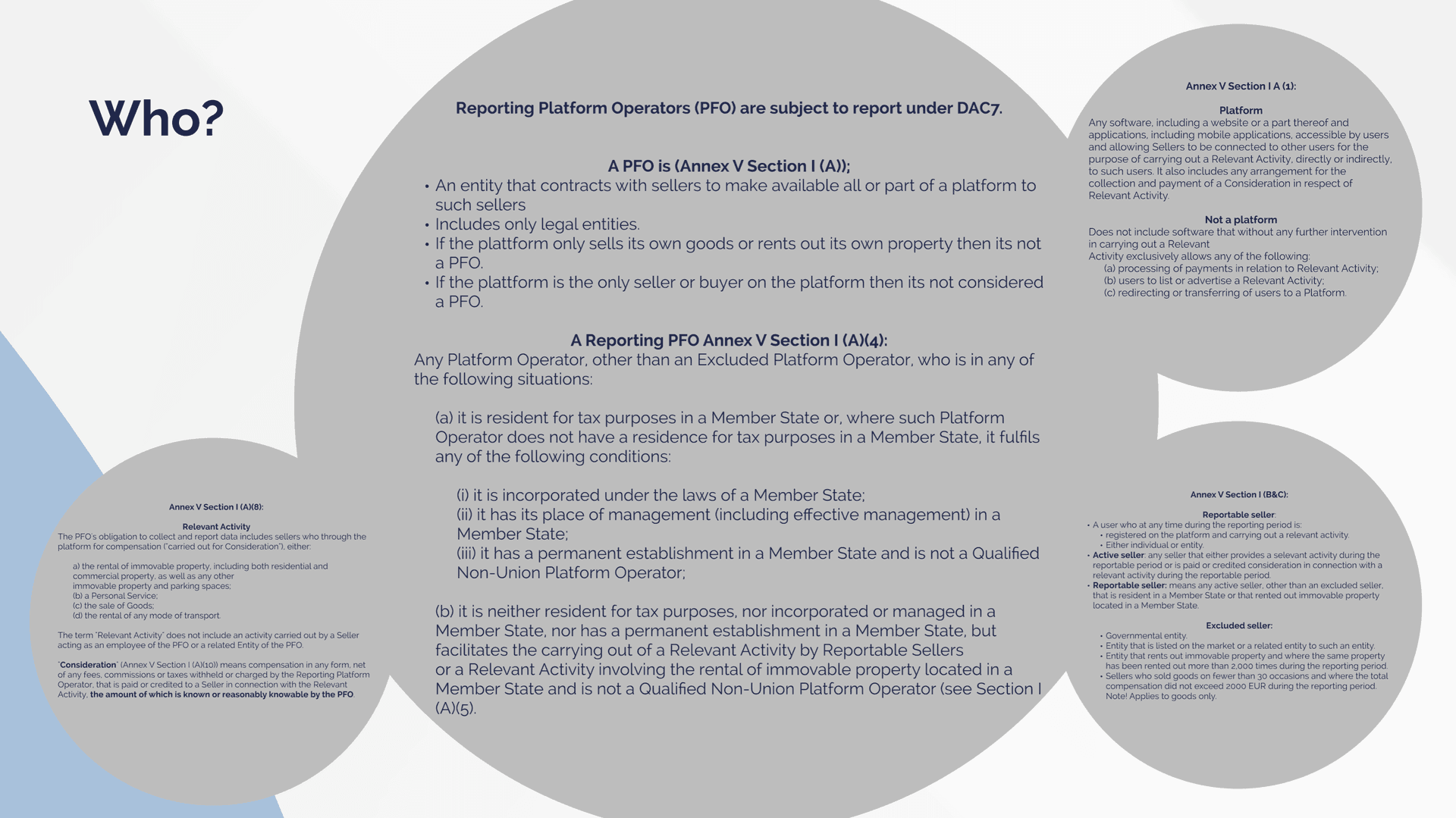

The EU tax landscape consists of a large amount of data and complex rules. The purpose of information gathering through various tax regulations is often well-intentioned—to combat tax evasion and various forms of tax avoidance. Since 2011, several reporting requirements related to taxation and accounting have been implemented at the EU level. Many of these initiatives are rooted in the OECD’s BEPS (Base Erosion and Profit Shifting) work, which began around 2011/2012. In addition to the implemented rules, proposals for even more reporting requirements have been put forward, and additional ones may be proposed in the future. To gain a comprehensive perspective on the reporting requirements that have been implemented in recent years in the tax field, we have mapped all relevant initiatives presented on the EU level since 2011 (find the presentation here).

Our analysis focuses on the evolving EU reporting landscape from 2011 to 2024, charting the implementation of 14 significant reporting directives across tax and accounting areas. These directives, while intended to enhance transparency and combat financial misconduct, have been criticized for being too far-reaching and having a negative impact on legal certainty principles.

The principle of proportionality demands that regulations should only impose necessary and proportionate measures, aligning legislative intent with practical outcomes. However, rapid introductions of numerous new reporting requirements have sometimes overlooked these principles, leading to ambiguous frameworks that challenge both businesses and tax authorities.

Moreover, as reporting obligations become increasingly automated and data-intensive, concerns over data security and the objectivity of data analysis becomes even more crucial. The centralization of data in EU databases raises valid concerns about data protection and the reliability of AI-driven analyses, where the ”black box problem” of AI opacity can obscure the fairness and accuracy of outcomes.

Legal Certainty Issues Linked to Increased Reporting

Looking ahead, as the EU Commission explores ways to streamline reporting burdens and enhance efficiency, there is a strong need to prioritize clarity and relevance in regulatory frameworks (it is however unclear how e.g. ViDA will live up to this ambition). In the beginning of May, the EU Commission opened a consultation on the effectiveness of the directive on administrative cooperation in tax matters (DAC). The consultation will run until 30 July and is covering the original text of the DAC and its amendments up to DAC6. A week ago, the EU Commission also published a notice of its intention to evaluate the Anti-Tax Avoidance Directive (“ATAD”). The practical implications of these ”decluttering” measures in the EU Commission’s efforts to reduce reporting burdens for companies however remain somewhat unclear. We believe that the forthcoming work should adopt a decluttering perspective with the aim of removing directives that no longer serve their purpose or have been replaced by similar requirements. For a more detailed discussion, we refer to our attached paper.

In conclusion, while the digitization of tax reporting could facilitate improved transparency and compliance, achieving a balance between regulatory rigor and legal certainty remains paramount. Future discussions must center on refining reporting frameworks to ensure that they do not only serve their intended purpose effectively but also uphold fundamental principles of predictability, proportionality, and objectivity. The focus should be on developing new ways to analyze existing data using new digital tools, rather than additional requests for more information without a clear understanding of its purpose. Understanding the implications of data-driven tax policies will be crucial in shaping a tax environment that is both robust and fair for all stakeholders.

Kvalitativ lagstiftning och företagens administrativa börda måste tas på allvar

Under tisdagen lämnade Niklas Karlsson m.fl. (S) en motion med anledning av Regeringens proposition 2025/26:102 Utbyte av uppgifter i tilläggsskatterapport och kompletteringar av förfarandet av tilläggsskatt för företag i stora koncerner. I motionen föreslås att ”regeringen bör genomföra en samlad k...

Halva skattebördan på en femtedel av hushållen

Den femtedel av hushållen med högst ekonomisk standard står för cirka hälften av den slutliga skatten. Det kan jämföras med mindre än fem procent för den femtedel med lägst ekonomisk standard. Det är viktigt att ha med sig i debatten om marginalskatterna, skriver skatteexpert Fredrik Carlgren.

Podd om sponsring

Utredningen om skatteincitament för juridiska personers gåvor till ideell verksamhet har lagt fram ett förslag på en ny avdragsregel för utgifter för sponsring. Förslaget är nu på remiss fram till den 4 maj. Men varför behövs det egentligen en ny avdragsregel och hur är den tänkt att fungera? I dett...

Rätt incitament för FoU

Nytt poddavsnitt där Katarina Bartels och Fredrik Carlgren är med och berättar om de två alternativa lösningar för hur ett system för skatteincitament för företagens investeringar i forskning och utveckling kan utformas som nyligen presenterades av regeringens utredare. Modellen med förhöjt kostnads...

Jantelagen

Svenskt Näringsliv har låtit Ipsos undersöka attityder till förmögenhet i Sverige och grannländerna Norge, Finland, Danmark och Estland. Anders Ydstedt är med i detta avsnitt av podden Skattefrågan och berättar om resultaten. Det visar sig att vi är betydligt mindre avundsjuka på varandra än vad vi ...

Höjda trösklar för revision - men inte i Sverige

Enligt en färsk studie från den europeiska revisorsorganisationen Accountancy Europe har en majoritet av de europeiska länderna höjt storleksgränserna för revisionsplikt under den senaste femårsperioden. Sedan den förra undersökningen gjordes 2021 har 22 av de 32 europeiska länder som ingått i under...