Is the Swedish VAT rate 26 percent rather than 25 percent?

The total cost of handling VAT for Swedish companies amounts to approximately 1.51 billion EUR per year. Since companies need to cover these costs, they will pass them on in prices. By accounting for this effect through distributing and weighting the administrative costs in the same way as VAT revenues, it implies that the standard VAT rate for consumers is rather 26% than 25%. This difference is significant. For instance, Finland recently raised its standard VAT by 1.5 percentage points to stabilize public finances.

The Confederation of Swedish Enterprise together with the consulting firm Trinovo, is releasing the second report on the regulatory burden of VAT, focusing on international transactions. This report complements the report from 2023 that addressed domestic transactions.

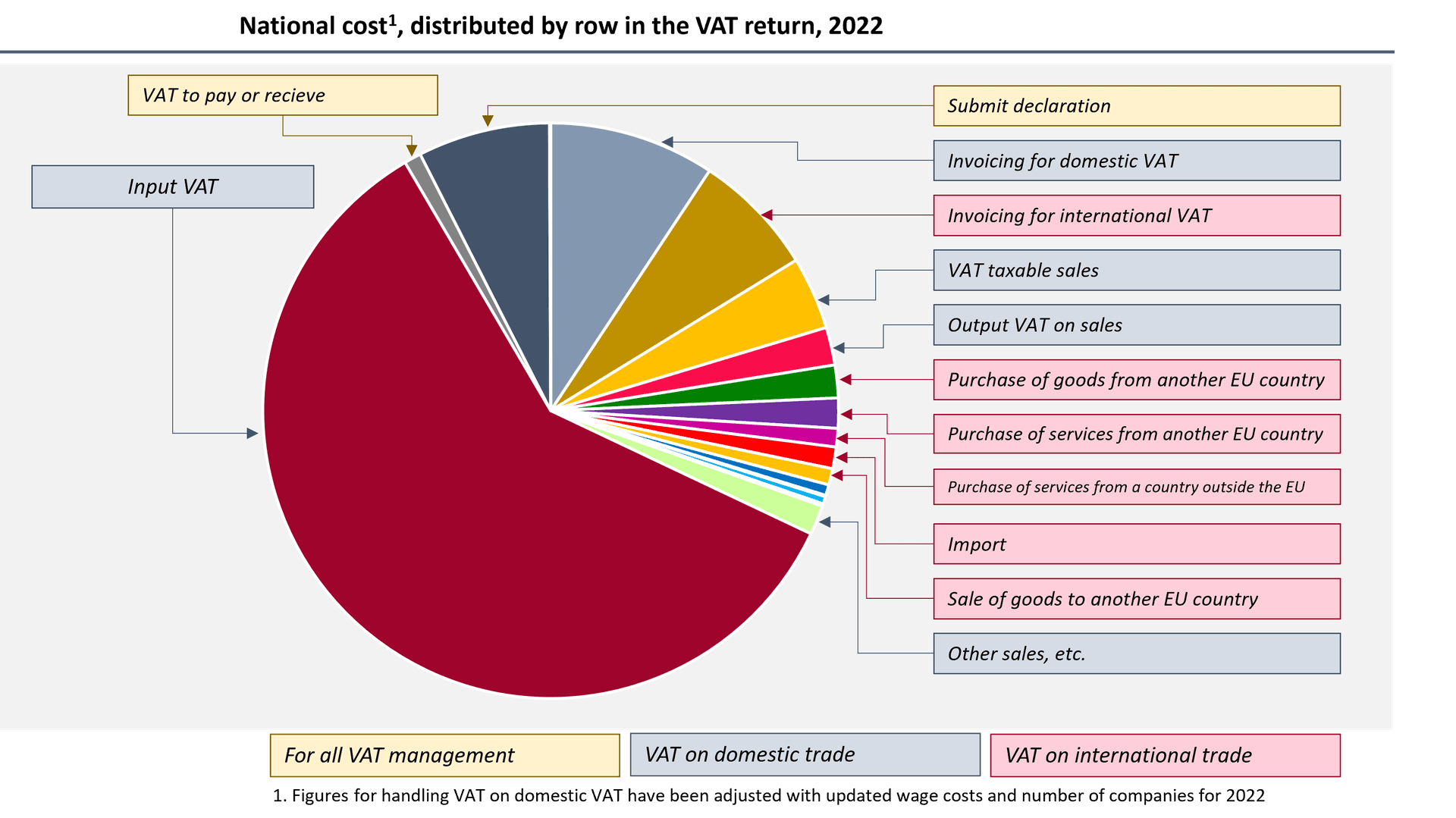

The total cost can now be broken down into national and international levels. The results show that approximately 15%, or 224 million EUR (2.6 billion SEK), stems from international trade, while the remaining 85% concerns domestic transactions, amounting to 1.29 billion EUR (14.9 billion SEK, adjusted for 2022). This difference is largely because fewer companies engage in international trade than within Sweden. Approximately 71% of large companies (with over 500 employees) operate in an international market, compared to just 6% of the smallest companies.

When looking at the aggregate level, costs differ between company segments for international and domestic management. At domestic level, smaller companies bear the highest cost, while larger companies incur higher costs in cross-border operations. This is likely due to the broader range of goods and services, more complex business models, and the higher volume of international transactions conducted by larger companies. In turn, this leads to more evaluations and cost-driving processes in trade with other countries.

When administrative costs are broken down by company size, the same pattern as in the first report is observed: costs increase with company size. However, the results present a relatively unexpected picture in comparing company segments for domestic and international transactions. Smaller companies with 1–49 employees have a lower cost per company in international trade compared to domestic. This may be because these companies tend to have relatively straightforward processes when entering international markets, which are complex to expand or scale. Another reason could be that they are suppliers to larger companies that set certain conditions for how a transaction should be treated.

The results show that we need to work toward simpler regulations at both the national and international levels. VAT is a relatively efficient tax, with fewer distortive effects on economic decisions than many other taxes—when it operates as intended. To some extent, lawmakers have responded to the call for regulatory simplification. Investigations are ongoing in Sweden regarding VAT on commercial leases, donations, and second-hand goods. At the EU level, there are initiatives to review the VAT directive in both the short and long term. The regulatory simplification discussion has been elevated on the political agenda in both Sweden and the EU, which is positive.

A large part of the issues can be traced to the right to deduct input VAT. At the national level, administering input VAT accounts for approximately 70% of total costs. When the study includes international transactions, this share decreases, but administrative tasks related to input VAT still constitutes over half of the total administrative costs. Part of the effort to ensure VAT deductions involves system setup for customers and suppliers, a process that is especially time-consuming for cross-border transactions. It is therefore important that reform efforts focus on proposals that ensure the right to deduct input VAT, which would simplify administration and reduce costs.

Kvalitativ lagstiftning och företagens administrativa börda måste tas på allvar

Under tisdagen lämnade Niklas Karlsson m.fl. (S) en motion med anledning av Regeringens proposition 2025/26:102 Utbyte av uppgifter i tilläggsskatterapport och kompletteringar av förfarandet av tilläggsskatt för företag i stora koncerner. I motionen föreslås att ”regeringen bör genomföra en samlad k...

Halva skattebördan på en femtedel av hushållen

Den femtedel av hushållen med högst ekonomisk standard står för cirka hälften av den slutliga skatten. Det kan jämföras med mindre än fem procent för den femtedel med lägst ekonomisk standard. Det är viktigt att ha med sig i debatten om marginalskatterna, skriver skatteexpert Fredrik Carlgren.

Podd om sponsring

Utredningen om skatteincitament för juridiska personers gåvor till ideell verksamhet har lagt fram ett förslag på en ny avdragsregel för utgifter för sponsring. Förslaget är nu på remiss fram till den 4 maj. Men varför behövs det egentligen en ny avdragsregel och hur är den tänkt att fungera? I dett...

Rätt incitament för FoU

Nytt poddavsnitt där Katarina Bartels och Fredrik Carlgren är med och berättar om de två alternativa lösningar för hur ett system för skatteincitament för företagens investeringar i forskning och utveckling kan utformas som nyligen presenterades av regeringens utredare. Modellen med förhöjt kostnads...

Jantelagen

Svenskt Näringsliv har låtit Ipsos undersöka attityder till förmögenhet i Sverige och grannländerna Norge, Finland, Danmark och Estland. Anders Ydstedt är med i detta avsnitt av podden Skattefrågan och berättar om resultaten. Det visar sig att vi är betydligt mindre avundsjuka på varandra än vad vi ...

Höjda trösklar för revision - men inte i Sverige

Enligt en färsk studie från den europeiska revisorsorganisationen Accountancy Europe har en majoritet av de europeiska länderna höjt storleksgränserna för revisionsplikt under den senaste femårsperioden. Sedan den förra undersökningen gjordes 2021 har 22 av de 32 europeiska länder som ingått i under...